Business insights – Macroeconomic outlook

A brief overview of what we know and what we do not know about 2021.

Covid-19 and the measures to tackle the virus have definitely hit hard on the economies, not only in Vietnam but also globally. Supply chains have been disrupted, orders canceled, investment plans delayed or scrapped. But for many businesses the question remains: how will all of this develop in 2021. Herewith, we try to find some answers but will also highlight the main uncertainties, which still remain.

My recent article readings or public statements in Vietnam were on the automotive market but also a summary of the Research Centre for Employment Relations and a general report on the situation in Khanh Hoa province.

The latter stated, in a year-on-year comparison 96.1% more businesses ‘suspended’ their operations and the applications for unemployment nearly doubled. Sector hit very hard in the recent months were tourism, textile and footwear. The year-on-year comparison of revenues from goods and services went down 30.5% mainly due to three reasons: Firstly, lack of orders; secondly, lack of raw materials for production; and lastly, a complete lack of international tourism which means the cancelations in total reached 79 – 82 %.

The Research Centre for Employment Relations also states the outsourcing order cancelations from large foreign enterprises in the footwear sector as main reason to cut labour costs in Vietnam. A survey showed that 63% in the footwear industry and 71% in the apparel sector have cut their labour costs. These two sectors have seen a high rate of order cancelations but slow or no payments; deferred shipments and damages on stored products and have suspended production or offered their goods to 50-70% lower prices.

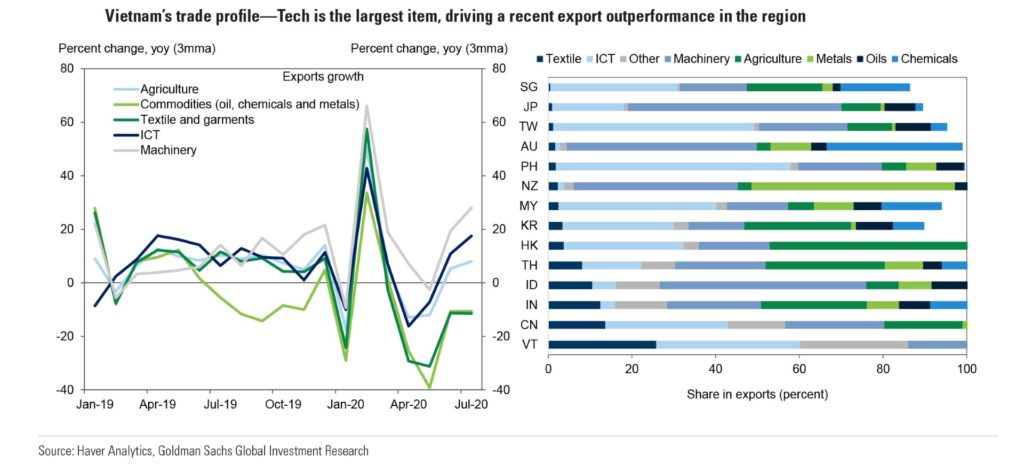

On the other hand, the electronics supply chain seems to be less disrupted. Fewer order cancelations have been reported and much better communication with regular discourses (due to the nature of the supply chain and efficiency in the production) seem to have smoothened the Covid-19 fallout in this sector.

News from the Vietnamese automotive market and the development of share values of the major distributors (Haxaco, TMT Motors, Giai Phong Motor) give less hope than the electronics sector. Vocabulary like ‘slumping auto market’ or ‘languish’ or ‘too early to assess’, is being used. Clearer is the assessment that the second wave of Covid-19 in Vietnam has affected workers, jobs, consumer demand ‘caused a lot of business pain’. These three examples describe a bit what is going on in the market and can be summarized in GDP statistics.

So, let us begin with some figures of the current status in 2020. Even though most figures for 2020 are heavily criticized, an annualized growth rate for Vietnam of 0.36 % appears to be not underrated. This would keep the GDP in US-$ at 261 billion. Nevertheless, the impact on the labor force and underemployment cannot be properly estimated (2.7 % unemployment rate and 76.6 % labour force participation rate could be stated for 2020).

The outlook towards 2021 seems to be even more of a wishful thinking or a doomsday prophecy. The same source states a GDP growth rate of 6.5% for Vietnam; but a total GDP of 250 bn US-$, while unemployment rate and labour force participation rate increase modestly. Consequently, let us have a different look, as Vietnam’s economic indicators – investments and orders, jobs, consumption and growth – and probably your business here, are to a large portion dependent on exports and thus on what is happening in the markets in the USA, China and Europe.

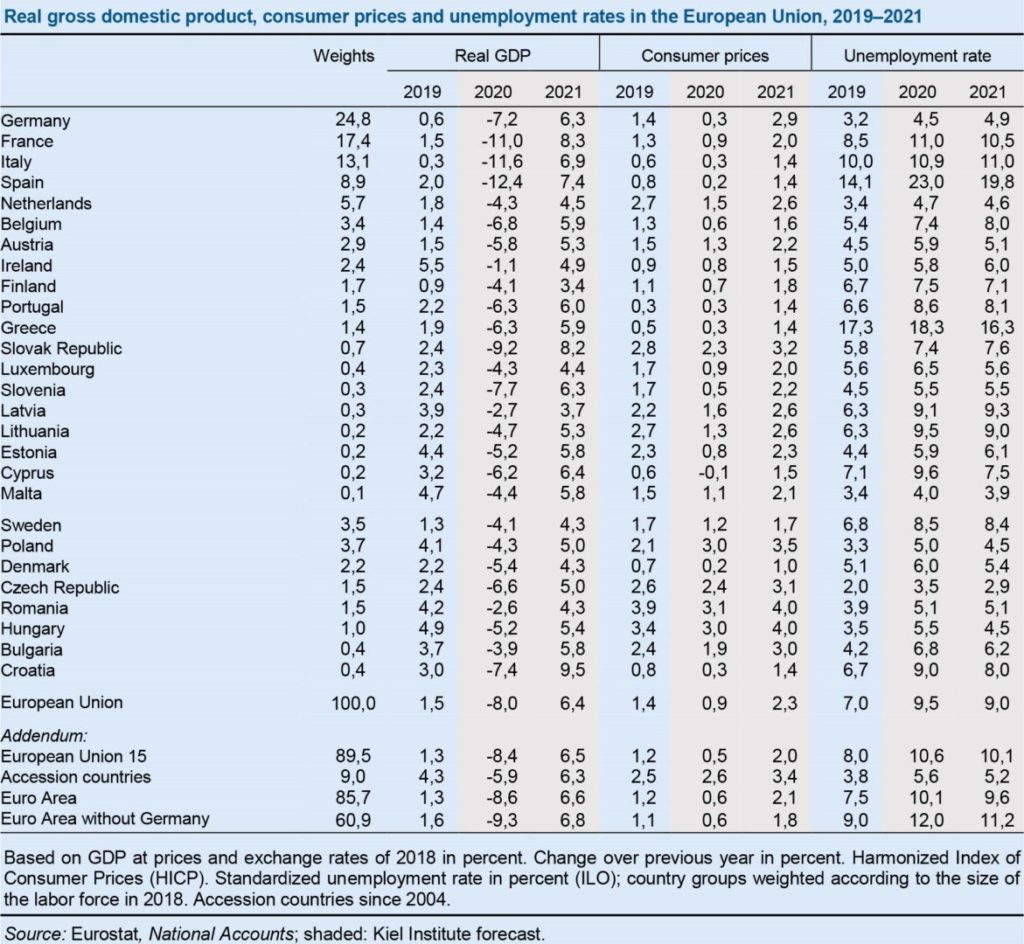

The measures of Covid-19 lockdowns, consumer insecurity and job-losses hit Europe hard. A recession is expected to hit the EU in 2020 (minus 14.4 % GDP). Despite still rising unemployment in 2021 (7.9% and a slightly declining labour force participation rate of 56.7%), a 4.2 % GDP growth rebound is being forecasted. But Covid-19 hit the USA, Vietnam’s biggest export market, even worse than the EU so far. It is still very hard to guess the figures for 2020 (an unemployment rate of at least 8.4 %, whilst having a labour force participation rate of 61.7%) but a GDP contraction of min. 9.1% is being expected. A recovery in 2021 will take time in the USA: meagre 2.2 % is being forecasted. I suppose all analysts are very cautious with any figures coming from the USA in a highly politicized environment and proper publications and analysis will be done, once their presidential elections are settled.

In order to consider what these partly very bleak outlooks mean for the Vietnamese economic development and your business here, I would suggest having a closer look at Europe’s strongest and largest economy: Germany.

The 2020 forecast is pretty clear: minus 11.3% GDP but a modest unemployment of 4.4 %. (The latter thanks to a model of governmentally supported underemployment and lower wages for less hours. But this keeps the labour force participation rate at a similar rate like in the USA: around 62 %.) It has to be stated here that the worst case scenario for Germany is currently being doubted. Several institutes see “only” a 6.3 % decline in GDP. A rate which is deemed still acceptable compared to other major economies over Europe; except Poland, which is forecasting a moderate 4.6 % decline of GDP. An interesting point on Germany is an expected strong bounce back in 2021: an impressive 6.5 % GDP growth is being forecasted and unemployment to go down nearly one percentage point. But to be clear what these two GDP figures 2020 and 2021 mean: nearly 150 billion US-$ goods and services are being less produced, consumed and paid for in the German economy. For 2020 the total GDP in US-$ should be 3,845bn and end of 2021 US-$ 3,700bn (not comparing it to the 2019 figure of the “all time high” in 2018 US-$ 3950bn). In comparison, one big player in the automotive supply chain is Slovakia with an expected 2020 total GDP of US-$ 105bn. Slovakia will see this year a minus of 12 % of GDP, which should then being followed by a 5.5 % GDP growth in 2021.

Like in Germany and Slovakia, the Vietnamese automotive market started to become an important sector. In Vietnam the focus did not yet lay on export markets, but on creating jobs, growth and benefit from the domestic consumption. What remains very unclear is the recovery time. Supposedly, the Covid-19 waves can be controlled, no nation-wide lockdowns are necessary and mid 2021 vaccines are widespread or not needed anymore, the economies and sectors we touched on, will see a pretty recovery.

The economists from the Kiel Institute for the World Economy do not only see a surprisingly strong domestic demand in Germany, but also identify five reasons for a strong, already started, recovery of the German economy. As a first reason a comparison with other European countries is being made: before Covid-19 and its impact, the UK has been suffering from huge uncertainties due to their exit of the European Union; the French economy is suffering from a constant resistance for economic reform; while the Italian economy has been suffering from a decade-long stagnation; and Spain is still recovering from and partly still suffering on the aftermath of the Euro crisis. Not Germany’s economy. Allegedly, Germany did not suffer from these structural problems and was healthy before Covid-19. While German businesses enjoyed a decade-long booming economy and could build up reserves, at the beginning of 2020 the order books of German businesses were full and when the crisis hit, they still had to work on pre-existing orders.

As a second reason, the German economy did not have to be put in a long-lasting artificial coma. The lockdown measures have not been nation-wide and strict like in many other countries in Europe, due to the rate of Covid-19 infections and death tolls. Even though, exports and industrial production is still below pre-Covid level, the strong industry focus of the German economy and their good position in the Chinese market makes enterprises in Germany suffer less and bounce back better. All these compared to the major European economies, like France, Italy or Spain, where the “complete collapse of tourism” disrupted their economies massively. As a fourth reason is the robust German budget relevant. The massive and constantly prolonged government support packages are not being doubted at all. German debts have been at 60% of GDP in the beginning of 2020, while the massive deficit packages will bring this up to 80% in 2020. Nevertheless, only Poland has a lower total debt among the big 6 economies in the EU. The fifth and last reason is related to the not exploding unemployment rates: firstly, the massive government interventions, which also includes the partly nationalized airline giant Lufthansa, and secondly, the support packages for businesses but also thirdly, the “Kurzarbeit”-model (where employers reduce the working hours of employees instead of laying them off) kept many jobs alive. But here already a warning is being stated clearly: what if this does not last? What if a new wave starts? What if Lufthansa and others have to fire thousands of people? There are many pessimistic questions, but within German enterprises the confidence and optimism are comparable to August 2019 – as long as other major economies keep recovering.

In consequence, it looks like the local government measures and relatively good Chinese economy saves Vietnam’s 2020 performance – even having growth whilst many economies in the SEA region show negative figures or recessions. It should be stated here that many forecasts and predictions for the global economy 2021 are using economic recovery lessons from the Chinese economy, which was first affected but also recovered earliest and Vietnam’s policy makers have learnt and keep learning from their neighbour. And should the global economy recover in 2021 as predicted, the local economy would be ready to benefit. But I would like to highlight some facts that these fictional figures cannot tell but seem to assume: The examples from Germany, Slovakia and other countries exemplify again that homework needs to be done.

On the one hand, several Covid-19 business support packages are being questioned (e.g. in Austria) with the argument of creating a zombie business landscape. Enterprises are being held artificially alive through state aid whilst no restructuring, business model adaptation or innovative approaches are being driven forward. It is dangerous to follow policies under the assumption that once the Covid-19 crises will have passed by, these zombies could be revived and go back to business as usual. In my opinion this assumption will prove disastrous for certain sectors, regions or the common understanding of how enterprises should work. Smart re-shifting and restructuring of support packages have to be done until the end of 2020. Otherwise, a sudden end of support packages would let these zombies die anyway. Additionally, the economic fall-out or the disruption of supply chains and destabilization of employment have just been delayed but not prevented – with a massive amount of budget deficits. I assume, we commonly agree that zombie businesses are not worth it.

On the other hand, we should have a look at specific sectors and their commonly shared practices. As highlighted in the beginning, the supply chain practices and communication in the footwear or the electronics sector are completely different and provided absolutely different outcomes during these crises. Following can also be observed: many restructuring operations, general re-focusing of business units or delayed but already scheduled rearrangements of company processes and products are happening now. Some started early when the USA or Europe went into lockdown. Some are already in full swing. Many enterprises have given up on the figures and profits of 2020 and rightfully questioned what they have to do differently to be successful in 2021 and beyond. The Covid-19 fallout gave them the necessary pressure but also the “free” time to do so.

Lastly, I would like to point out what everyone can also do with some free time: check the multitude of data, analysts, forecasts and predictions for 2020 and 2021. The experts do not know yet what is really going on, getting data in constantly and analyzing, updating and publishing it periodically. But so far, like many things in economics, all seems to be based on guesswork and working with different assumptions which points in one direction: a quite tough hit global economy with the hopes for good recovery in 2021 (if nothing happens) and Vietnam seems to have gone through it quite well. But this does not tell us anything about the efficiency and preparedness of the individual enterprises. What it tells us, is that many people lost their jobs, have or had to work for less salary and still are encouraged to keep consumption up and running. What it also tells us, is that some sectors are in a survival struggle and have to reinvent their businesses in the one way or another (e.g. airline industries, tourism). But we can clearly get the picture that some of the sub-sectors medical supplies, pharmaceuticals and everything related to online communication, web-based solutions and virtual working places are doing better than in 2019. All this tells me that we are currently in an economic cycle that shifts towards already before Covid-19 predicted growth markets; I do not read general publications anymore, which are dealing with the necessity of innovating and finding new areas of doing business. It is happening right now. And it is more than before a matter of survival of enterprises and jobs.

https://en.thesaigontimes.vn/tinbaichitiet/78513

https://en.thesaigontimes.vn/tinbaichitiet/78503/

https://vietnamnews.vn/economy/business-beat/772306/registration-fee-cut-does-little-to-revive-auto-market.html

These and all following data refers to https://tradingeconomics.com/ unless stated otherwise.

Kiel Institute Economic Outlook, World Economy, Summer 2020, No. 67 (2020/Q2). But even between 17. June and 17. September, the 2020 assessment and 2021 forecast vary already significantly. (GDP -5.5 % for 2020 and +4.8% in 2021): https://www.ifw-kiel.de/publications/media-information/2020/kiel-institute-economic-forecast-economic-recovery-loses-speed-after-quick-rebound/

Besides these two GDP decline figures for Germany and Poland, it should also be mentioned that the European Commission is forecasting -9.7 % for the UK, -10.6 % for France, -10.9 % for Spain, -11.2 % for Italy.

I intentionally would like to highlight one fact in all German economy articles and their reasoning of the recent decades: any comparison to the Netherlands is nowhere to be found. The Dutch economy seems to be doing also not too bad, comparable to the Polish, but the constant competition with their smaller Western but strong brother seems to spoil the storyline of shining heroes. As a reference for this, I recommend: https://www.spiegel.de/wirtschaft/warum-die-wirtschaft-in-deutschland-besser-durch-corona-kommt-als-anderswo-in-europa-a-71ad3142-13eb-4457-92d1-a55aa6e9e182

Author

Christoph Schill – Green Growth Consultant & Chief Representative Southeast Asia in PRACSIS

Christoph Schill has earned substantial expertise in finance and banking, human resource, project management and consultancy since 1996. The CEEC’s Vice-Chairman first came to Vietnam in 2010 as an organizational development & product innovation consultant. He worked in EuroCham Vietnam as a Project Manager before taking on his current Green Growth Consultant and Chief Representative position at Pracsis South East Asia, a Brussels based EU service provider.

Mr. Christoph Schill can be reached at office@ceecvn.org