Recent years have seen major economic changes in Vietnam. In 2023, the country slowed after years of rapid growth. Early 2024 has seen indications of recovery, bringing enterprises and investors opportunities and difficulties. This article forecasts Vietnam’s economic development and its ramifications for investors using the latest World Bank, ADB, National Statistical Office, etc. reports.

Recent years have seen major economic changes in Vietnam. In 2023, the country slowed after years of rapid growth. Early 2024 has seen indications of recovery, bringing enterprises and investors opportunities and difficulties. This article forecasts Vietnam’s economic development and its ramifications for investors using the latest World Bank, ADB, National Statistical Office, etc. reports. The first quarter of 2024 showed promising signs. Low export base impact drove GDP up 5.66% year over year. Goods exports rose 17.2% year-over-year. With quarterly growth rates of 4.9% and 4.7%, consumption and investment improved more slowly. In particular, US and Eurozone merchandise exports rose 25.5% and 16.3%, respectively. The first quarter of 2024 saw domestic consumption rise 4.9%, up from 3.0% the year before. Real investment climbed 4.7% year over year due to substantial FDI, while private investment remained low.

A cooling economy affected the labor market and income growth. Employment growth plummeted from 2.2% in Q1 2023 to 0.3% in Q1 2024. From 8.3% in 2017-19 to 1.3% in 2022-23, average monthly real incomes stagnated. The 2023 consumer poll found a drop in expenditures on durable goods like appliances, gadgets, and cars.

In 2023, Vietnam’s external position improved despite global issues. Current account surplus rose to 6.7% of GDP from 0.3% in 2022. Balance of payments surplus was 1.3% of GDP. The end of 2023 will see $93.3 billion in international reserves, 3.3 months of imports. This gain was driven by a significant product trade surplus, strong remittance inflows, and a narrowing services trade deficit as foreign tourism recovered to over 12.6 million visitors in 2023, up from 3.7 million in 2022. Imports fell 14.1%, outpacing exports (-8.5%), fueling the merchandise trade imbalance.

Supportive monetary and fiscal policies. Average headline inflation fell to 3.25% by 2023 as the economy cooled. The State Bank of Vietnam (SBV) slashed discount and refinancing rates by 150-200 basis points across four policy rate decreases in 2023. Despite these cuts, loan growth in 2023 was 13.7%, below the SBV predictions. The government operated a light expansionary fiscal policy in 2023. Compared to 2022, government revenue fell 5.4% and tax receipts 13.8%. Total spending rose 12.8%, mostly owing to governmental investment.

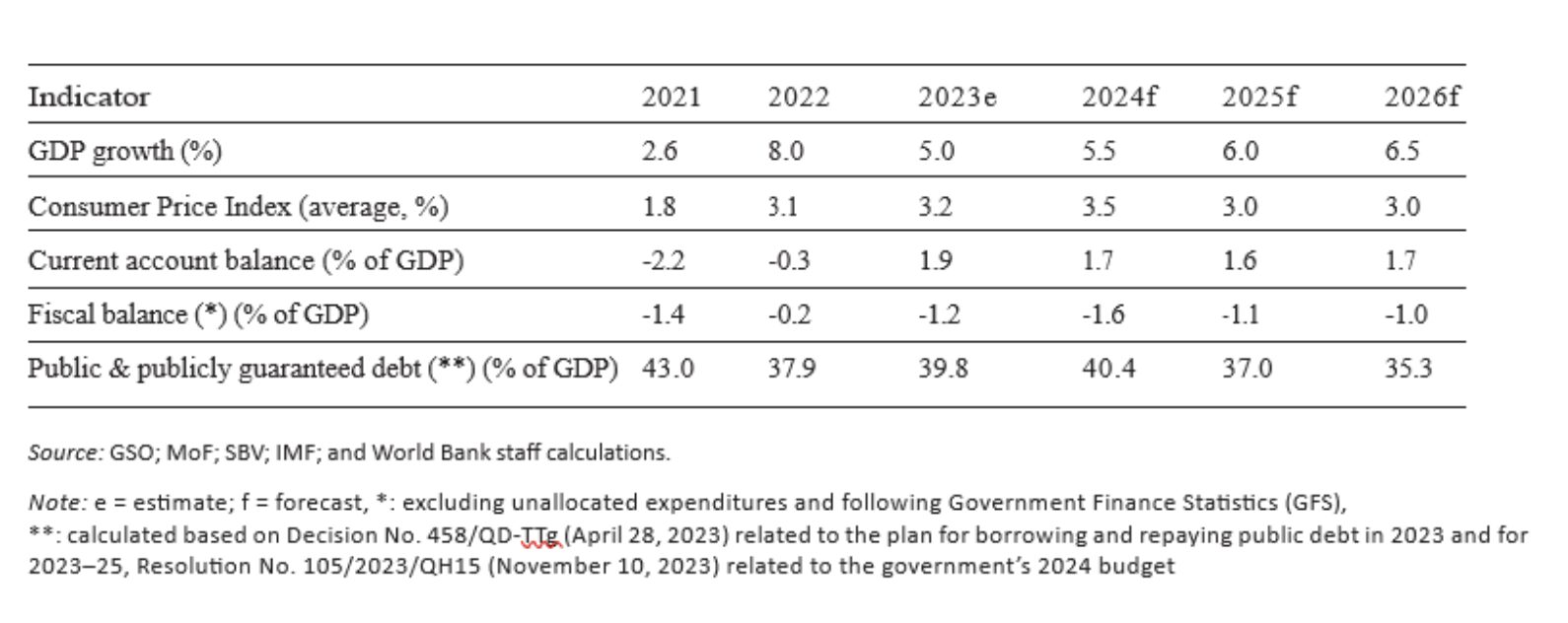

With balanced risks, Vietnam’s economic growth prospects are good. GDP should grow by 5.5% in 2024. Manufacturing exports will revive due to rising global demand, according to this projection. The real estate market should strengthen in late 2024 and early 2025. Investors and consumers will gain confidence as exports and the real estate market recover, boosting domestic demand.

Total real investment and private consumption are predicted to increase by 5.5% and 5.0%, respectively. Inflation is forecast to rise slightly from 3.2% in 2023 to 3.5% in 2024, owing to an increase in government-administered prices such as education and health care. The CPI is predicted to decline to 3.0% in 2025 and 2026, with commodity and energy prices remaining constant.

However, that image has risks. Slower-than-expected growth in advanced nations and China may diminish Vietnam’s export demand. Increased geopolitical conflicts and climate disasters pose risks. A delayed real estate market revival may affect investor optimism and private sector investment domestically.

Due to the slow real estate market, the financial sector’s asset quality might see a decline, which may hurt growth, especially at larger state-owned commercial banks with tiny capital buffers. On the other hand, even slightly strongerthan-expected global growth may boost Vietnam’s export sector faster.

Leveraging policy support is essential for investors. Accelerating public investment might raise aggregate demand and fill infrastructure constraints in the medium run. Given the interest rate differentials between local and international markets and currency rate pressure, additional interest rate cuts are limited. Additionally, monitoring the financial sector remains critical, as investors should understand bank capital adequacy initiatives and trust prudential oversight of institutional improvements. Transparent early action, bank resolution, and crisis management are part of this.

The need for structural and administrative reforms for longterm growth is undisputed. Addressing energy, transportation, and logistics infrastructure deficiencies is linked to improvements in public investment management. Strengthening the regulatory framework for backbone services like ICT, power, and transportation is of the same importance. Very recent developments, like the publication of the legal framework for direct power purchase agreements (DPPA), clearly point in the right direction.

Vietnam’s goal of becoming a high-income nation by 2045 requires improved creative entrepreneurship conditions to raise output. To support startups, the upgrade of the entrepreneurial ecosystem, including skills development programs, will contribute to the establishment of highervalue businesses. In this way, the sectoral shortage of qualified personnel on all levels will eventually be overcome.

Refocusing the national flagship program on establishing a pipeline of investment-ready, innovative entrepreneurs, enhancing crucial support instruments, and attracting qualified private operators and fund managers are ways to improve entrepreneurial outcomes. Accelerating regulatory reforms to ease investment procedures and increasing public research sector commitment to creative startups are important. This includes upgrading the intellectual property and technology transfer framework, strengthening performance evaluations, and expanding university and public research agency technology transfer capability. In particular, European businesses have proven in the past their willingness to share knowledge and technologies to create sustainable partnerships with domestic enterprises. Hence, a supportive legal framework will create mutual benefits.

This summary of areas for improvement is also the primary focus of our chamber’s advocacy and lobbying efforts, whether bilaterally or collaboratively, such as through Eurocham or other European business advocacy platforms. In conclusion, Vietnam’s economic prospects for 2024 and 2025 are cautiously hopeful. While the country has various obstacles, particularly in the labor market and the banking sector, there are considerable prospects for growth, particularly in exports and domestic consumption. Investors should stay up-to-date on the changing economic situation, take advantage of legislative incentives, and focus on areas that are ready for recovery and growth. With strategic investments and a focus on structural reforms, Vietnam remains an appealing business and investment location.

Florian J. Beranek Vice Chairman of CEEC