A sense of normality is evident in the office market in HCMC. Lifts are packed in the morning rush and restaurants kept busy during the lunchtime frenzy. Although variants may throw another giant spanner in the works the general direction that the office market will take in years following peak Covid is now being debated.

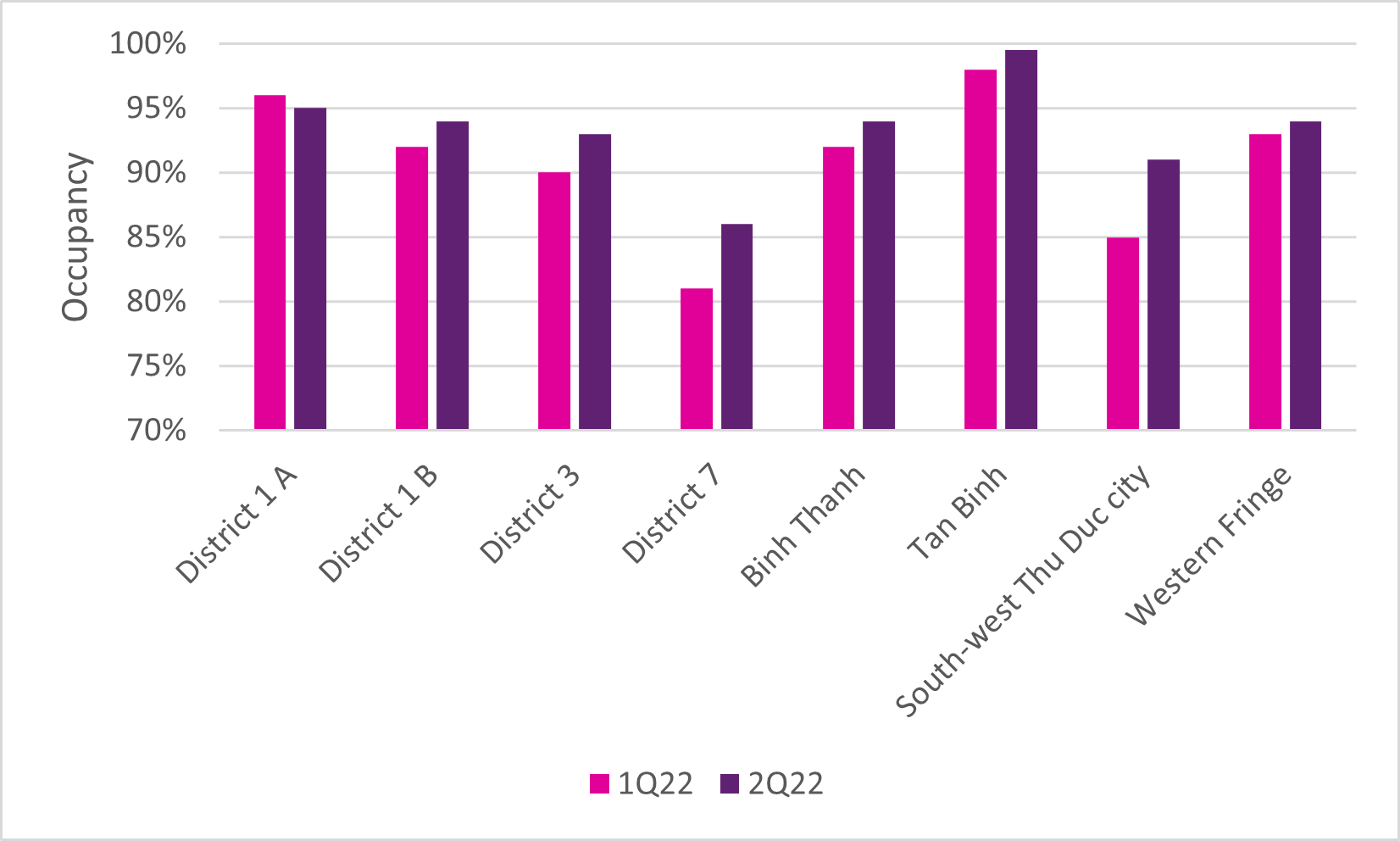

During the second quarter of 2022 occupancy rates in HCMC have risen in all main districts in the city pointing to a sense of optimism of future economic activity and putting an end to the notion of widespread hybrid working. While in Europe and America such a mix of work from home and office may continue, in most of Asia this is not expected to last once the perceived danger of the virus has fully abated. Firstly, the home environment is usually not conducive to home working plus commuting times to work are mostly less in Vietnam than in large cities in Europe. Also, the social esteem of working in an office is far greater for Asia’s generally younger office population.

Chart: Occupancy rates in Ho Chi Minh City

Source: Chestertons Vietnam Research & Advisory

Office rental rates have remained stable over the past quarter reflecting the usual practice of increasing volume rather than prices after a crisis. This is likely to occur also in other real estate sectors such as retail and hotels. However limited new supply in the District 1 CBD until 2024 will mean pressures on rental rates as occupancy comes ever close to 100%. However, the anticipated rise in rental rates could be tempered by a number of factors.

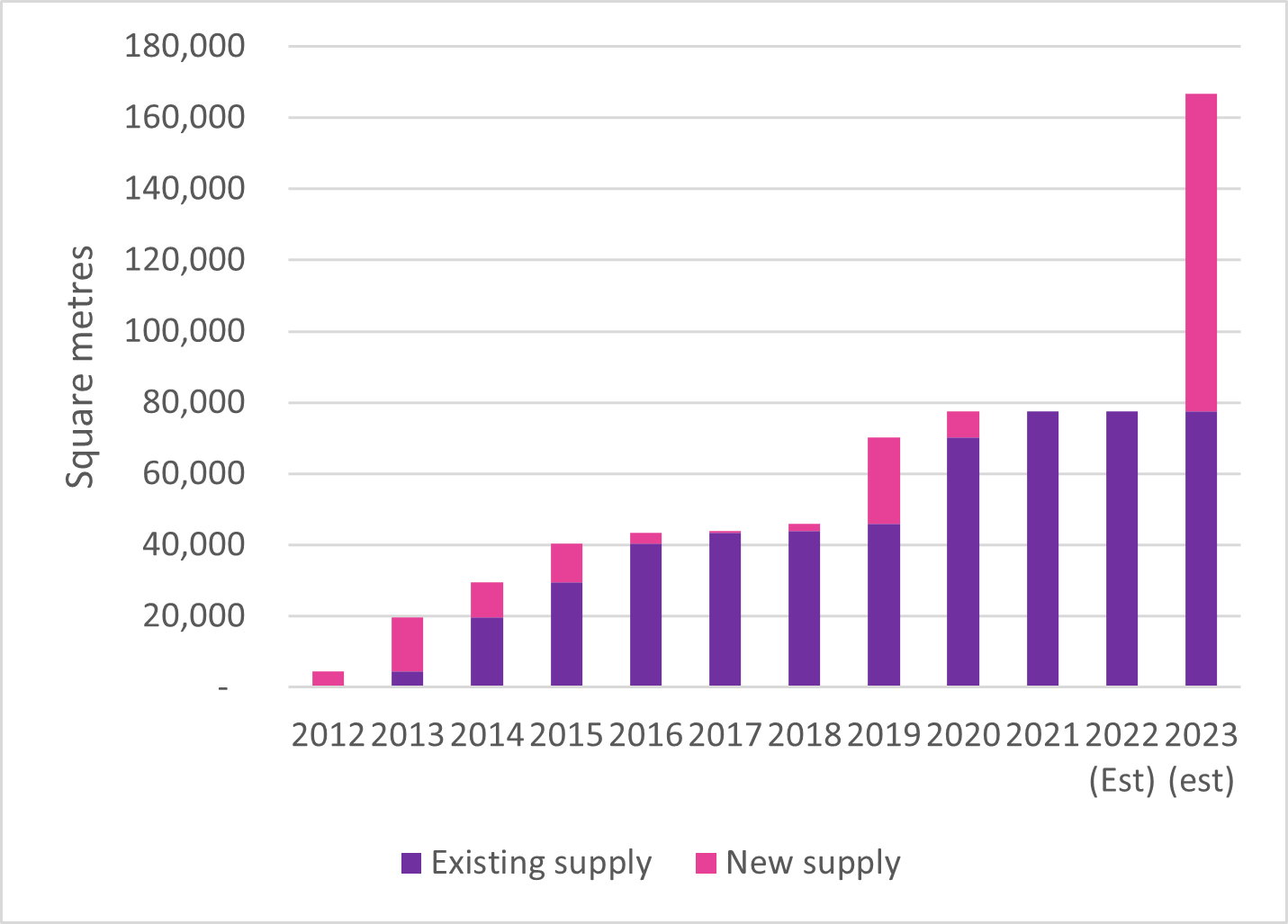

While a long time coming, south-west Thu Duc city (previously District 2) could benefit tenants as significant new supply of nearly 90,000 square metres from two new buildings is expected to hit the market in 2023. The opening in Q2 2022 of the Cau Thiem Bridge 2 connecting districts 1 and south-west

Thu Duc city means that they will be only a few minutes’ drive to the current CBD. This could herald the beginning of the “Pudong Effect” where the south-west Thu Duc city area acts as a spillover for the current CBD and perhaps a strong challenger as the prime office location of the city in the future.

Chart: Historical office supply in south-west Thu Duc city (formerly District 2)

Source: Chestertons Vietnam Research & Advisory

District 1 is still the magnet for multinational companies and while no new Grade B or above supply is expected to come to the market in 2023 the following year could see a surge with over 200,000 square meters being added. This would represent a nearly 20% increase from current supply and is likely to absorb demand.

The flexible (serviced) office market segment continues to go from strength to strength in Ho Chi Minh City with occupancy at record levels and the constraint on is the limitation of quality space for further expansion. Interestingly while the talk globally has been the rise of co-working spaces, the real trend is still dedicated office space with some areas set aside for public areas. Data security still remains a dominant factor so the co-working concept can be seen more in hotel lobbies for digital nomads and the wide array of coffee shops.

In fact, the most evident display of co-working is within the confines of a company’s own office space with more collaborative and fluid design concepts transplanting the more traditional model. The trend is therefore more one of flexibility in terms of use of existing office space, plus using flexible office locations on shorter term contracts with limited capital expenditure. Some companies are expanding by splitting into two or more locations such as for back-office functions enabled by cloud technology or the physical offices being closer to staff.

What this overall flexibility means is that rental rates are less likely to increase significantly even if demand outpaces supply. Tenants can easily adjust their office working practices to reduce or even eliminate space in expensive locations such as within the CBD. Flexible offices in the CBD provides the tenant with a prestigious address while having most staff working in more remote locations.

New office destinations are beginning to appear such as Phu Nhuan and as the metro lines finally begins operation this will change the dynamics of the office market. Future commercial development will gravitate to new mass transit stations plus the lines passing through district 1 will cement the district’s status as the prime CBD for the foreseeable future with south-west Thu Duc city potentially coming a close second. The world is going through uncertain times and Covid still remains a lingering cloud hanging over our daily lives. As necessity is the mother of invention then such uncertainty leads to the need for greater flexibility in how tenants adapt and prosper in this environment. The office market players in Vietnam are reacting to this with consequences that will impact the rest of the decade.

Author

W Business Center & Chestertons Vietnam